What Do Counties Do?

Counties in Iowa have a dual purpose:

- to provide state services and

- to determine local service needs.

Counties originally existed to carry out state functions at the local level, so counties have always been grassroots level governments. Iowa’s counties make a big impact on their citizens, whether it is human services, economic development, road maintenance, DARE programs, battered women’s shelters, home health care nurses, library improvements, elections (local, state and national), or county parks.

The Regional Government of Iowa

County governments are the quiet, consistent providers of essential services. Structurally, the county continues to serve as the regional government for Iowa. It performs many state administrative functions such as the issuance of licenses and permits. Also, it provides public services of a purely local nature such as the enforcement of zoning ordinances, the provision of health and indigent care, and the maintenance of county jails. Counties also cooperate among themselves in providing other services to meet their citizens’ needs.

Elected Offices

The vast number of public services that counties provide leads to a rather complex and somewhat confusing array of offices, boards, and commissions. Citizens elect a county Auditor, Recorder, Attorney, Sheriff, Treasurer and a 3-5 member county Board of Supervisors. Hardin County has a 3-member board.

Appointed Departments, Boards, and Commissions

The Board of Supervisors then appoints individuals to serve as directors for the other offices in the courthouse or in some cases a commission that is overseen by the Board of Supervisors appoints a director. The Conservation Board, for example, directly oversees the Conservation Director. While the Board of supervisors is the chief formulator of county policy, it is clear that the administration of county government programs is guided by a variety of elective and appointive offices, and a number of semi-autonomous boards and commissions.

County Funding

Property taxes are the main source of income for counties and make up approximately 43% of their budget on average statewide. The Iowa property tax is primarily a tax on “real property,” which is mostly land, buildings, structures and other improvements such as a building, house or mobile home, fences and paving.

Generally home owners pay less than half of the property tax collected each year in Iowa. Farmers pay 19%, utility companies 8%, and businesses and industry a total of 25%.

Limited Funding Options

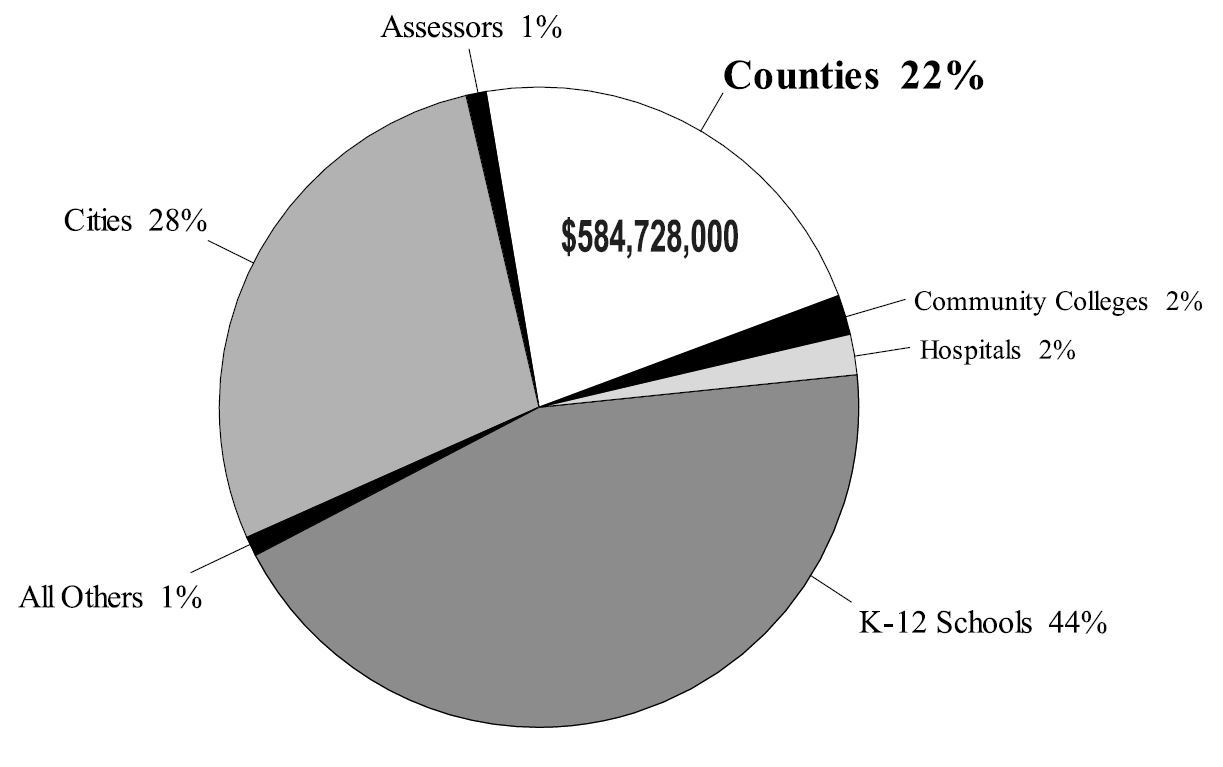

Counties have only a limited ability to raise money in other ways-one such way is the local option sales tax, only possible with a favorable vote from the citizenry. Iowa property taxes are allocated to several taxing authorities, as indicated on the chart to the right.

Average Allocation of Iowa Property Taxes

More Information

The Iowa State Association of Counties (ISAC) has numerous resources about county government and its functions.